STILL HAVE A QUESTION ?

Our support team will be ready to guide you.

| # | Title | Description | Image | Date | Source Link |

|---|---|---|---|---|---|

| 1 | Agriculture ministry launches online portal Ensure to connect with direct benefit transfer | The Agriculture Ministry launched online portal Ensure to connect with direct benefit transfer and provide simple, useful and transparent system to the beneficiary. Union Minister of Agriculture and Farmers’ Welfare Shri Radha Mohan Singh launched the portal ENSURE- National Livestock Mission- EDEG developed by NABARD and operated under the Department of Animal Husbandry, Dairying & Fisheries. “National Livestock Mission has been conceived by Modi government for the sustainable development of the livestock sector. Under the Mission’s component called Entrepreneurship Development and Employment Generation (EDEG), subsidy payment for activities related to poultry, small ruminants, pigs etc. through Direct Benefit Transfer (DBT) goes directly to the beneficiary’s account,” Singh said. |

|

12-Dec-2018 | News in Details |

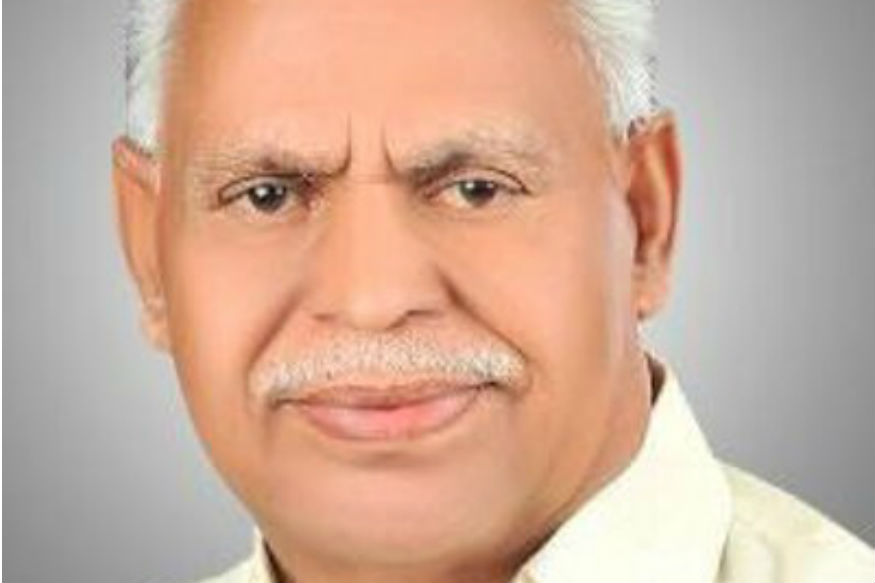

| 2 | Former Kerala Minister C N Balakrishnan Dead | Veteran Congress leader and former Kerala minister C N Balakrishnan died at a private hospital here, party sources said Tuesday.He was 84. Chief Minister Pinarayi Vijayan and Leader of the Opposition in the state assembly Ramesh Chennithala were among those who condoled his death. |

|

12-Dec-2018 | News in Details |

| 3 | Prime Minister Narendra Modi inaugurates fourth Partners’ Forum in New Delhi | Prime Minister Narendra Modi today inaugurated the fourth Partners’ Forum in New Delhi today. The objective of the conference is to improve knowledge, alignment and accountability to accelerate action on women's, children's and adolescents health. |

|

12-Dec-2018 | News in Details |

| 4 | RBI slaps Rs 1 cr fine on Indian Bank for violating cyber security norms | The Reserve Bank of India Tuesday said it has imposed a fine of Rs 1 crore on Indian Bank for violating cyber security norms. The RBI has imposed, by an order dated November 30, 2018, a monetary penalty of Rs 10 million on Indian Bank for contravention of Circular on Cyber Security Framework in banks, the central bank said in a release. The contravention is with regard to RBI's directions on Frauds- Classification and Reporting by Commercial Banks. "This penalty has been imposed in exercise of powers vested in RBI under the provisions of...the Banking Regulation Act, 1949 taking into account the failure of the bank to adhere to the aforesaid guidelines and directions issued by RBI," it said. This action is based on deficiencies in regulatory compliance and is not intended to pronounce upon the validity of any transaction or agreement entered into by the bank with its customers, the release added. |

|

12-Dec-2018 | News in Details |

| 5 | US Marines: Five missing after Japan crash declared dead | Five missing Marines have been declared dead by the US military, nearly a week after two aircraft collided and crashed into the sea off Japan. A massive search and rescue operation was mounted after the 6 December incident, involving a F/A-18 fighter and a KC-130 refuelling tanker carrying seven crew in total. One crew member survived, and Tuesday's announcement brings the final death toll to six The exact cause remains unclear. The crash is said to have occurred during a refuelling exercise but the US military has not confirmed this. "Every possible effort was made to recover our crew and I hope the families of these selfless Americans will find comfort in the incredible efforts made by US, Japanese, and Australian forces during the search," said US Marine Corps Lt Gen Eric Smith. The identities of the five Marines declared dead have not yet been released. The incident occurred in the early hours of 6 December about 200 miles (320km) off the coast of south-western Japan. The US planes had taken off from Marine Corps Air Station Iwakuni near Hiroshima and "were conducting regularly scheduled training when the mishap occurred", the III Marine Expeditionary Force said. |

|

12-Dec-2018 | News in Details |

| 6 | Slain journalist Khashoggi named Time magazine's "Person of the Year" | Saudi journalist Jamal Khashoggi, who was murdered in October at his country's Istanbul consulate, has been named Time magazine's "Person of the Year" alongside several other journalists. |

|

12-Dec-2018 | News in Details |

| 7 | Shaktikanta Das to succeed Urjit Patel as RBI governor | Former bureaucrat Shaktikanta Das on Tuesday was appointed as new RBI governor for a period of three years. He had served as former secretary of Department of Economic Affairs from 2015 to 2017. The latest development comes a day after Urjit Patel resigned from the post citing “personal reasons”. On Monday, Patel had stepped down after a fractious faceoff with the government, underlining the deepening trust deficit between the RBI and the central government. Das will assume the charge as the 25th Governor. His biggest challenge would be to handle the pressure from the government on issues such as the restructuring of loans, infusing liquidity and sticking to its strict default norms for resolution of bad debts in banks’ books, where the Centre has favoured a more lenient approach. |

|

12-Dec-2018 | News in Details |

| 8 | Govt’s contribution to NPS hiked to 14%, more tax benefits for subscribers | The Union Cabinet on Monday approved a slew of measures to offer more benefits to members of the National Pension Scheme (NPS). Under the new approved changes, the Centre’s contribution to NPS has been increased to 14 per cent of from 10 per cent of the basic salary, said Finance Minister Arun Jaitley. Addressing the press conference, Jaitley said NPS subscribers will now be able to withdraw 60 per cent of the accumulated corpus without having to pay any tax on it. The move is set to benefit around 36 lakh subscribers and will provide a massive boost to the NDA government ahead of the 2019 general elections.

The government-sponsored pension scheme was launched in January 2004 for government employees but it was expanded for all sections in 2009.

Subscribers are allowed to contribute regularly in a pension account during their working years; on retirement, subscribers can withdraw a part of the total amount in lump sum and use the remaining corpus to buy an annuity and secure a regular income after retirement. As of now, the minimum employee contribution in NPS is 10 per cent of the basic pay and an equal contribution is made by the government. However, the cabinet has decided to now offer 4 per cent more contribution in order to offer better returns. |

|

11-Dec-2018 | News in Details |

| 9 | Prof Mushirul Hasan, renowned historian, passes away at 71 | Padma Shri Professor Mushirul Hasan, a renowned historian who served as vice-chancellor of Jamia Millia Islamia, passed away early Monday morning. He was 71. A former Director General of the National Archives of India, Hasan has been credited for writing extensively on the partition of India, and histories of Islam in south-Asia. He served as the Pro Vice-Chancellor of Jamia between 1992-96 and later in the capacity of VC between 2004-09. “He met with a road accident about two years ago and was mostly bed-ridden after that. He was also undergoing dialysis for kidney problems,” former secretary to Jamia Vice chancellor, Zafar Nawaz Hashmi, told PTI. He added, “Some health complications emerged and he was taken to hospital post midnight. He passed away there this morning.” Hasan, who has been known for his contribution to social sciences was also the former Vice-Chairman, Indian Institute of Advanced Study, former president of Indo-Iran Society in Iran Embassy and former president of Indian History Congress in 2002 among numerous other posts he held in his illustrious career. |

|

11-Dec-2018 | News in Details |

| 10 | RBI governor Urjit Patel resigns: Steps down, stands up | UNDERLINING the deepening trust deficit between the Reserve Bank of India and the central government, RBI Governor Urjit Patel resigned Monday, almost 10 months ahead of his term — ending the shortest tenure a central banker in India has had since 1992. That’s why Patel’s announcement caught many including some of the board members of the RBI by surprise. Sources said that much before Section 7 (1) of the RBI Act was invoked — the first formal process of discussions with the Governor before the government issues a directive — Patel had indicated that he would step down if push came to shove. |

|

11-Dec-2018 | News in Details |